Definition: What is a Check?

A check is a written order directing a bank to pay a specific amount of money from the check writer's account to the designated recipient (payee). It's a fundamental tool for financial transactions.

Checks are legal documents and require accurate information to be valid. They are still widely used for various payments, from personal bills to business expenses.

How to Write a Check: Step-by-Step Instructions

Here's a simple seven-step guide to writing a check:

1. Date: Write the current date on the top right corner. Checks are typically valid for a certain period, usually 180 days, so ensure it's up-to-date.

2. Payee: On the 'Pay to the order of' line, clearly write the full name of the person or company you are paying. Use the exact name to avoid any issues.

3. Amount (Numeric): In the box marked with a dollar sign ($), write the numerical amount of the payment.

4. Amount (Written): On the line below the 'Pay to the order of' line, write the amount in words. Spell out the amount, and use 'and' to separate dollars and cents. For example, 'One hundred twenty-five and 00/100'.

5. Memo: Use the 'Memo' line to add a brief note about the payment, such as the bill's purpose or the account number. This is for your reference and the payee's.

6. Review: Double-check all the information you've filled out, including the date, payee, and amounts (both numerical and written).

7. Signature: Sign your name on the signature line in the lower right corner. This authorizes the bank to release the funds.

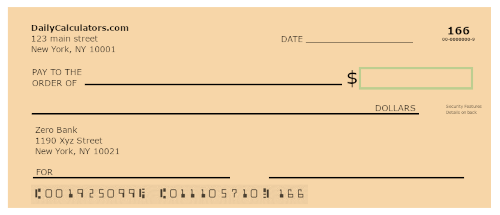

Understanding the Parts of a Check

Checks have pre-printed and fill-in sections. Understanding these parts is critical for writing a valid check.

Pre-printed Information: This includes your personal information (name and address), your bank's name and logo, the bank's routing number (ABA number), and your account number.

Fill-in Information: This includes the payee line, the dollar box (numerical amount), the amount in words, the memo line (optional), the date, and your signature.

“Writing a check is more than just filling out blanks; it's a formal transaction requiring accuracy and attention to detail.

Financial Expert

Explore More

Additional Resources

Print Checks at Home

Learn how to print checks for your personal or small business needs. From compatible printers to templates, this resource covers the basics.

Sample Check

View a sample check with all the necessary fields filled out to understand the layout and information needed.

Deciphering the ABA Number

The American Bankers Association (ABA) routing number is a nine-digit number that identifies the bank and branch where your account is held.

This number is essential for electronic transactions, such as direct deposits and online bill payments, in addition to check processing.

You can find your bank's ABA number at the bottom of your checks or by checking your bank's website or contact information.