Definition What is a Check?

A check is a written order instructing your bank to pay a specific amount of money from your account to the person or entity named on the check (the payee). It's a fundamental tool for making payments and managing finances.

Checks are legally binding documents, so accuracy is crucial. Understanding the components and proper check-writing procedure will help you protect your funds.

Step-by-Step How to Write a Check: 7 Simple Steps

Follow these seven steps to correctly write a check:

1. Date: Write the current date in the top right corner. This is the date the check is issued.

2. Payee: On the 'Pay to the order of' line, write the full name of the person or company you're paying. Double-check the spelling!

3. Amount (Numeric): In the box with the dollar sign ($), write the amount you're paying in numbers (e.g., $125.50).

4. Amount (Written Out): On the line below the 'Pay to the order of' line, write the amount in words. Start at the far left of the line. For cents, write the amount as a fraction (e.g., 'fifty and 50/100').

5. Memo: In the 'Memo' or 'For' line, write the purpose of the payment (e.g., 'Rent', 'Invoice #1234'). This is for your record and helps you keep track of expenses.

6. Review: Before signing, carefully review all the information on the check to ensure accuracy.

7. Signature: Sign your name on the signature line in the bottom right corner.

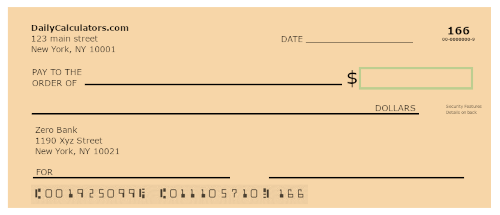

Anatomy Understanding the Parts of a Check

Checks have pre-printed and fill-in sections. Understanding each part helps ensure accuracy:

Pre-printed information:

* Your Information: Your name and/or address.

* Bank Information: Bank's name, logo, and contact info.

* Routing Number: A nine-digit code identifying your bank for processing.

* Account Number: Your unique account number at the bank.

* Check Number: A reference number for your records.

* ABA Number: American Bankers Association number, used for bank identification and processing.

Fill-in sections:

* Payee Line: Where you write the name of the recipient.

* Dollar Box: Where you write the amount in numerical format.

* Amount in Words: Where you write the amount in words.

* Memo: For personal reference or for the payee's reference.

* Date: The date the check is issued.

* Signature: Your authorized signature.

“Accuracy is paramount when writing a check. Double-check every detail before signing.

Financial Advisor

Enhance Your Knowledge

Interactive features to further help you master check writing

Check Template Download

Download a free check writing template to practice or print checks at home.

Check Writing Mistake Quiz

Test your knowledge with a quiz about common mistakes in check writing.

Key Detail What is an ABA Number?

The ABA number (American Bankers Association) is a unique routing transit number used by banks in the United States. It identifies the specific financial institution and helps facilitate the clearing of checks and other financial transactions. This number is critical for accurate and efficient processing.

The ABA number is typically printed on the bottom left corner of a check.