What is A Check?

A check is a written order instructing a bank to pay a specific amount of money from the check writer's account to the person or entity named on the check (the payee). Checks remain a legitimate payment method, even in an increasingly digital world. Understanding how to write a check correctly is essential for managing your finances.

This comprehensive guide will walk you through every step, ensuring accuracy and confidence in your check-writing skills.

7 Steps to Writing a Check

Follow these simple steps to ensure your checks are filled out correctly:

1. Date: Write the current date on the top right corner. This is crucial as checks typically have an expiration period (often 180 days).

2. Payee: On the 'Pay to the order of' line, write the full, correct name of the person or business you are paying. Ensure accuracy to avoid any issues.

3. Amount (Numeric): In the box next to the dollar sign ($), write the exact amount in numbers, including the decimal point for cents.

4. Amount (Written): On the line below the 'Pay to the order of' line, write out the amount in words. Use the standard format, such as 'One hundred twenty-five and 00/100'. Ensure you spell it correctly to avoid problems with processing.

5. Memo: In the 'Memo' or 'For' section (usually in the lower-left corner), add a note about the purpose of the payment. This can be for personal reference or at the request of the payee (e.g., your account number for a bill payment).

6. Review: Before signing, double-check all information to ensure accuracy. Confirm the date, payee, and amount (both numeric and written).

7. Signature: Once you've verified everything, sign the check on the designated line in the bottom right corner. Without a signature, the check is not valid.

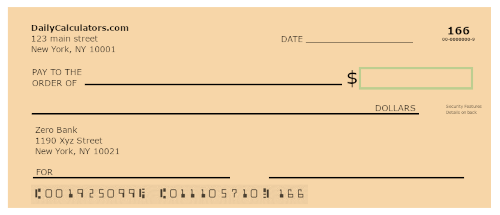

Understanding Check Components

Checks have pre-printed information and areas you need to fill out. Here’s a breakdown:

Pre-Printed Information:

* Your Information: Your name and/or address (the account holder).

* Bank Details: The bank's name, logo, and branch contact information.

* Routing Number: A nine-digit number used to identify your bank branch for clearing checks. Also known as the ABA (American Bankers Association) number.

* Account Number: Your unique bank account number.

* Check Number: A reference number for your checkbook.

Information You Fill Out:

* Payee: The name of the recipient.

* Dollar Box: The payment amount in numbers.

* Amount in Words: The payment amount written out.

* Memo: A brief note about the payment (optional).

* Date: The date the check is issued.

* Signature: Your official signature.

The ABA Routing Number

The ABA routing number (also known as the bank's routing number or transit number) is a nine-digit code that identifies the financial institution on which a check is drawn. This number is essential for processing checks electronically and for direct deposits.

It's typically found in the lower-left corner of your check. This code is crucial for electronic transactions like direct deposits and bill payments.

“A check is more than just a piece of paper; it's a financial instrument requiring precision and care.

Financial Expert

Enhance Your Knowledge

Interactive elements to help you

Check Writing Quiz

Test your knowledge with a quick quiz. See how well you understand the steps involved in writing a check. Score your proficiency!

Check Template Download

Download a printable check template for practice. You can use this to hone your check-writing skills and become more familiar with the format.

Check Writing Mistakes to Avoid

Common errors can cause delays or rejection of your checks. Be mindful of these pitfalls:

* Incorrect Date: Ensure it’s current.

* Incorrect Payee Name: Misspellings will cause problems.

* Amount Discrepancies: Ensure the numeric and written amounts match. If they don't, the bank typically uses the written amount.

* Missing Signature: A check without a signature is invalid.

* Insufficient Funds: Always ensure you have enough money in your account to cover the check.

* Altering a Check: Never make changes to a check once it’s written. This could be considered fraud.

Numbers to Words Conversion Guide

Here’s a handy guide to convert numbers to words, helping ensure accuracy:

(Include a list of numbers and their word representations as provided in the original content. For example: 0 - Zero, 1 - One, 2 - Two, etc. up to 1,000,000,000,000)